alameda county property tax calculator

The median property tax in Alameda County California is 3993 per year for a home worth the median value of 590900. But remember that your property tax dollars pay for needed services like schools roads libraries and fire departments.

Business Property Tax In California What You Need To Know

City level tax rates in this county apply to assessed value which is.

. Situated on the eastern shore of the San Francisco Bay Alameda County contains the cities of Oakland Berkeley and Fremont among others. The exact property tax levied depends on the county in Montana the property is located in. Alameda County collects on average 068 of a propertys assessed fair market value as property tax.

Make sure you review your tax card and look at comparable homes. Census Bureau American Community Survey 2006-2010. This calculator is excellent for making general property tax comparisons between different states and counties but you may want to use our California property tax records tool to get more accurate estimates for an individual property.

If youre a resident of Alameda County California and you own property your annual property tax bill is probably not your favorite piece of mail. Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010. Montana is ranked 24th of the 50 states for property taxes as a percentage of median income.

In many cases we can compute a more personalized property tax estimate based on your propertys actual assessment valuations. Property taxes are calculated by multiplying your municipalitys effective tax rate by the most recent assessment of your property. The property tax rate in the county is 078.

The median annual property tax payment in Santa Clara County is 6650. Missoula County collects the highest property tax in Montana levying an average of 093 of median home value yearly in property taxes while Wibaux County has. Santa Clara County property tax.

The average effective property tax rate in Alameda County is 078. Alameda County has one of the highest median property taxes in the United States and is ranked 68th of the 3143 counties in order of median property taxes. Use our property tax calculator to see how these taxes can affect your monthly mortgage payment.

Alameda County property tax.

Understanding California S Property Taxes

Understanding California S Property Taxes

Alameda County Ca Property Tax Calculator Smartasset

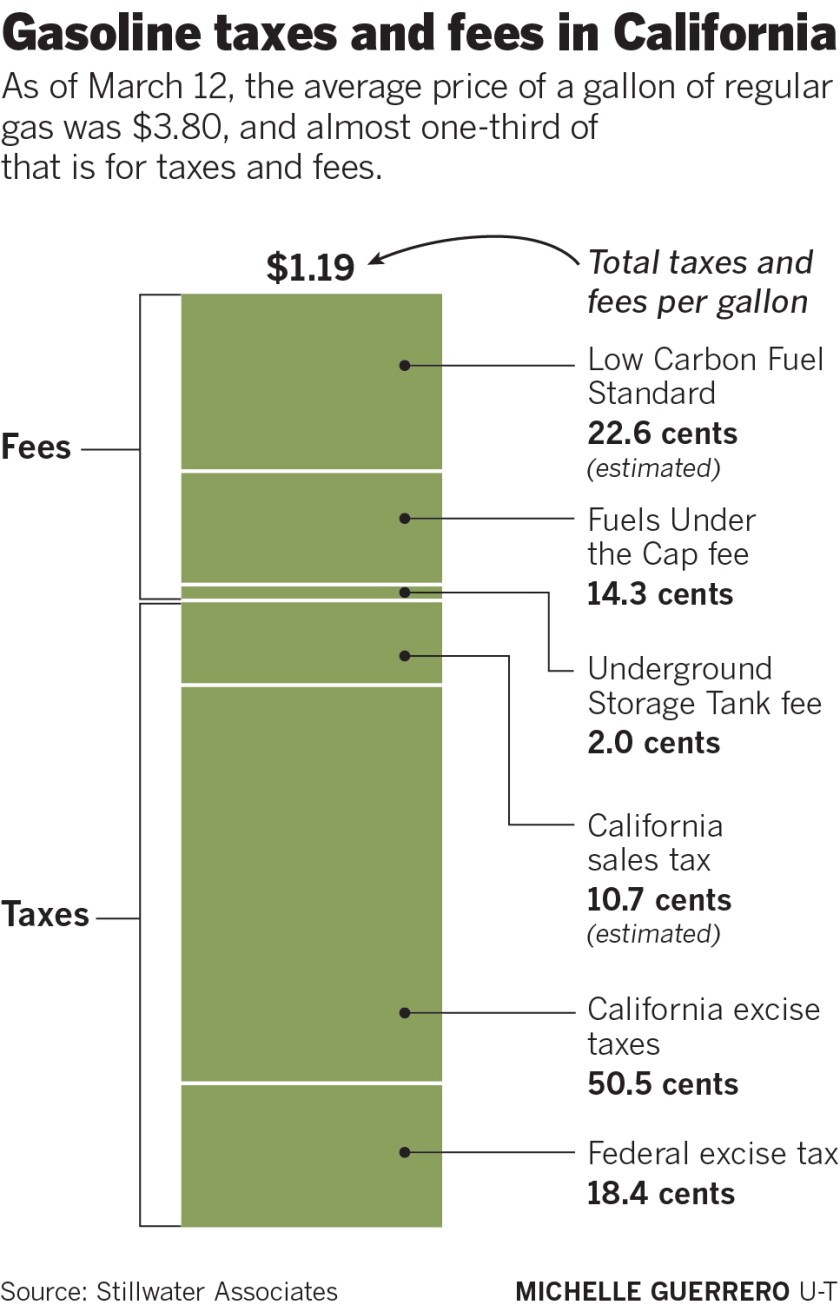

How Much Are You Paying In Taxes And Fees For Gasoline In California The San Diego Union Tribune

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Understanding California S Property Taxes

Transfer Tax Alameda County California Who Pays What

County Begins Collecting Higher Sales Tax Local News Stories Hmbreview Com

Santa Clara County Ca Property Tax Calculator Smartasset

Exterior Beverly At Eastwood Village In Irvine Ca Brookfield Residential Brookfield Residential New Homes Residences

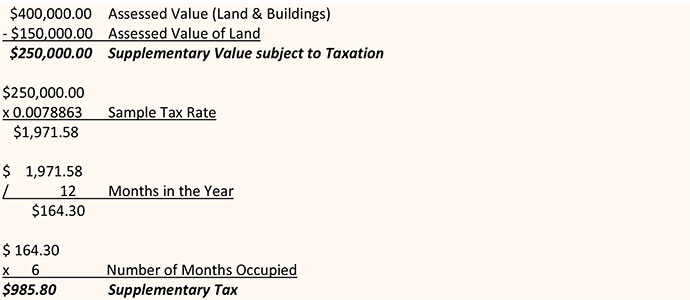

How Is Supplementary Tax Calculated The City Of Red Deer

Transfer Tax Alameda County California Who Pays What

Alameda County Ca Property Tax Calculator Smartasset

City Of Oakland Check Your Property Tax Special Assessment

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

Search Unsecured Property Taxes

Alameda County Ca Property Tax Search And Records Propertyshark